Multiple Choice

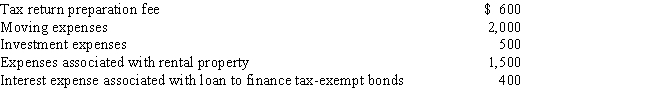

Cory incurred and paid the following expenses:  Calculate the amount that Cory can deduct (before any percentage limitations) .

Calculate the amount that Cory can deduct (before any percentage limitations) .

A) $5,000.

B) $4,600.

C) $3,000.

D) $1,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Ordinary and necessary business expenses, other than

Q22: Describe the circumstances under which a taxpayer

Q22: Investigation of a business unrelated to one's

Q37: For a taxpayer who is engaged in

Q43: Briefly explain why interest on money borrowed

Q58: Which of the following is not deductible?<br>A)Moving

Q59: Sammy, a calendar year cash basis taxpayer

Q61: Petal, Inc. is an accrual basis taxpayer.

Q129: Marge sells land to her adult son,

Q140: Bobby operates a drug-trafficking business. Because he