Multiple Choice

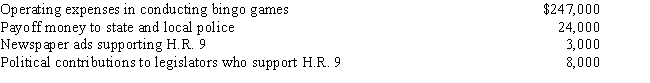

Rex, a cash basis calendar year taxpayer, runs a bingo operation which is illegal under state law. During 2017, a bill designated H.R. 9 is introduced into the state legislature which, if enacted, would legitimize bingo games. In 2017, Rex had the following expenses: Of these expenditures, Rex may deduct:

A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Salaries are considered an ordinary and necessary

Q49: Marvin spends the following amounts on a

Q52: Iris, a calendar year cash basis taxpayer,

Q54: If an activity involves horses, a profit

Q55: Under the "one-year rule" for the current

Q57: Which of the following is correct?<br>A) A

Q58: Which of the following is not deductible?<br>A)Moving

Q76: A baseball team that pays a star

Q87: Under what circumstances may a taxpayer deduct

Q145: Discuss the application of the "one-year rule"