Essay

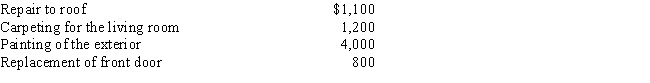

Marvin spends the following amounts on a house he owns:

a.How much of these expenses can Marvin deduct if the house is his principal residence?

b.How much of these expenses can Marvin deduct if he rents the house to a tenant?

c.Classify any deductible expenses as deductions for AGI or as deductions from AGI.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Salaries are considered an ordinary and necessary

Q44: The stock of Eagle, Inc. is owned

Q45: The cash method can be used even

Q47: Are all personal expenses disallowed as deductions?

Q52: Iris, a calendar year cash basis taxpayer,

Q53: Rex, a cash basis calendar year taxpayer,

Q76: A baseball team that pays a star

Q87: Under what circumstances may a taxpayer deduct

Q88: LD Partnership, a cash basis taxpayer, purchases

Q145: Discuss the application of the "one-year rule"