Essay

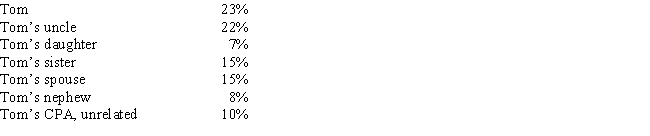

The stock of Eagle, Inc. is owned as follows:

Tom sells land and a building to Eagle, Inc. for $212,000. His adjusted basis for these assets is $225,000. Calculate Tom's realized and recognized loss associated with the sale.

Correct Answer:

Verified

Tom's realized loss is $13,000.

Ho...

Ho...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Walt wants to give his daughter $1,800

Q40: The cost of legal advice associated with

Q41: Albie operates an illegal drug-running business and

Q45: The cash method can be used even

Q47: Are all personal expenses disallowed as deductions?

Q49: Marvin spends the following amounts on a

Q50: Nikeya sells land (adjusted basis of $120,000)

Q53: In distinguishing whether an activity is a

Q87: Under what circumstances may a taxpayer deduct

Q88: LD Partnership, a cash basis taxpayer, purchases