Essay

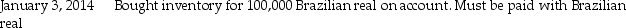

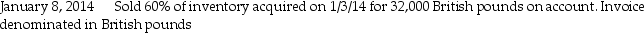

Meric Corporation (a U.S.company)began operations on January 1,2014,when the owner borrowed $150,000 to start the company.In the first month of operations,Meric had the following transactions:

January 28,2014 Collected half of the 32,000 pounds from the customer in Great Britain and immediately converted them into U.S, dollars The following exchange rates apply:

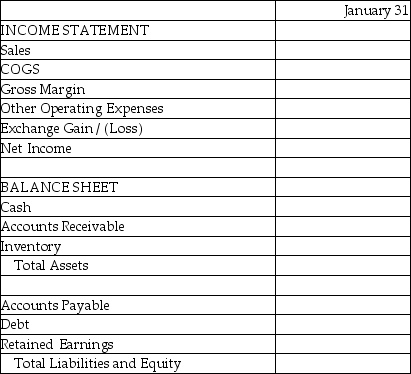

Required:

Complete the summary income statement and balance sheet for the month ended January 31,2014 assuming there were no other transactions.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Plymouth Corporation (a U.S.company)began operations on

Q41: Forward contracts are negotiated contracts between three

Q42: Crabby Industries,a U.S.corporation,purchased inventory from a company

Q43: A put option requires the seller to

Q44: When the billing for a U.S.company's sale

Q45: Behd Company,a U.S.firm,sold some of its inventory

Q46: In September of 2014,Gunny Corporation anticipates

Q47: The common characteristic of derivatives is the

Q48: Floating exchange rates reflect fluctuating market prices

Q49: Ulysses Company purchases goods from China amounting