Multiple Choice

Use the following information to answer the question(s) below.

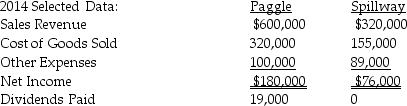

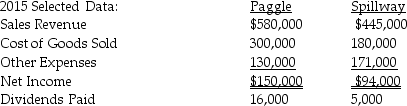

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

-If the sale referred to above was a downstream sale,by what amount must Inventory on the consolidated balance sheet be reduced to reflect the correct balance as of the end of 2014?

A) $3,000

B) $10,000

C) $14,000

D) $20,000

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Pirate Transport bought 80% of the outstanding

Q33: Pexo Industries purchases the majority of their

Q34: Psalm Enterprises owns 90% of the outstanding

Q35: On January 1,2014,Palling Corporation purchased 70% of

Q36: Sales by a subsidiary to its parent

Q38: On January 1,2014,Plastam Industries acquired an 80%

Q39: Use the following information to answer the

Q40: A downstream sale is a sale by

Q41: Swamp Co.,a 55%-owned subsidiary of Pond Inc.,made

Q42: A subsidiary's realized income is its reported