Essay

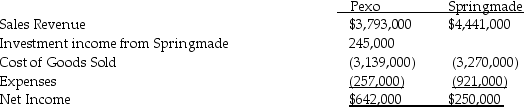

Pexo Industries purchases the majority of their raw materials from a wholly-owned subsidiary,Springmade Chemicals.Pexo purchased Springmade to assure supply availability at a time when the materials were being rationed in the industry due to supply issues overseas.Pexo was able to purchase Springmade at the book value of Springmade's net assets.At the time of purchase,the book value and fair value of Springmade's net assets were equal.Pexo purchased $2,890,000 of materials from Springmade in 2014 alone.All intercompany sales are made at 120% of cost,although Springmade is able to mark up their products 80% to other outside buyers.Pexo carried inventory on their books at the beginning and end of the year in the amount of $450,000 and $480,000,respectively,all of which had been purchased from Springmade.Income statement information for both companies for 2014 is as follows:

Required:

Required:

Prepare a consolidated income statement for Pexo Corporation and Subsidiary for 2014.

Correct Answer:

Verified

Consolidated Cost of Goods S...

Consolidated Cost of Goods S...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: Use the following information to answer the

Q29: Use the following information to answer the

Q30: Papal Corporation acquired an 80% interest in

Q31: Use the following information to answer the

Q32: Pirate Transport bought 80% of the outstanding

Q34: Psalm Enterprises owns 90% of the outstanding

Q35: On January 1,2014,Palling Corporation purchased 70% of

Q36: Sales by a subsidiary to its parent

Q37: Use the following information to answer the

Q38: On January 1,2014,Plastam Industries acquired an 80%