Multiple Choice

Use the following information to answer the question(s) below.

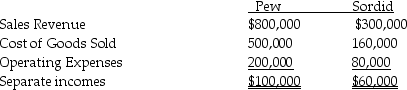

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

-The 2014 consolidated income statement showed noncontrolling interest share of

A) $3,200.

B) $6,400.

C) $8,800.

D) $12,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: On January 1,2014,Paar Incorporated paid $38,500 for

Q2: The elimination entry under the perpetual inventory

Q3: Phast Corporation owns a 80% interest in

Q4: Use the following information to answer the

Q6: Pfeifer Corporation acquired an 80% interest in

Q7: Penguin Corporation acquired a 60% interest in

Q8: The ending inventory of the purchasing affiliate

Q9: Consolidated financial statements eliminate unrealized gross profit

Q10: Presented below are several figures reported for

Q11: If a subsidiary is a 100 percent-owned