Essay

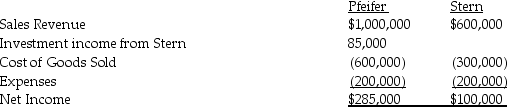

Pfeifer Corporation acquired an 80% interest in Stern Corporation several years ago when the book values and fair values of Stern's assets and liabilities were equal.At the time of acquisition,the cost of the 80% interest was equal to 80% of the book value of Stern's net assets.Separate company income statements for Pfeifer and Stern for the year ended December 31,2014 are summarized as follows:

During 2013,Pfeifer sold merchandise that cost $120,000 to Stern for $180,000.Half of this merchandise remained in Stern's inventory at December 31,2013.During 2014,Pfeifer sold merchandise that cost $150,000 to Stern for $225,000.One-third of this merchandise remained in Stern's December 31,2014 inventory.

During 2013,Pfeifer sold merchandise that cost $120,000 to Stern for $180,000.Half of this merchandise remained in Stern's inventory at December 31,2013.During 2014,Pfeifer sold merchandise that cost $150,000 to Stern for $225,000.One-third of this merchandise remained in Stern's December 31,2014 inventory.

Required:

Prepare a consolidated income statement for Pfeifer Corporation and Subsidiary for 2014.

Correct Answer:

Verified

Consolidated cost of goods s...

Consolidated cost of goods s...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: On January 1,2014,Paar Incorporated paid $38,500 for

Q2: The elimination entry under the perpetual inventory

Q3: Phast Corporation owns a 80% interest in

Q4: Use the following information to answer the

Q5: Use the following information to answer the

Q7: Penguin Corporation acquired a 60% interest in

Q8: The ending inventory of the purchasing affiliate

Q9: Consolidated financial statements eliminate unrealized gross profit

Q10: Presented below are several figures reported for

Q11: If a subsidiary is a 100 percent-owned