Multiple Choice

Use the following information to answer the question(s) below..

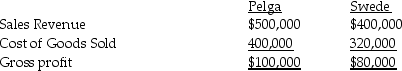

Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000. Half of this merchandise remained in Pelga's December 31, 2014 inventory. This inventory was sold in 2015. During 2015, Swede sold merchandise that cost $160,000 to Pelga for $200,000. $62,500 of the 2015 merchandise inventory remained in Pelga's December 31, 2015 inventory. Selected income statement information for the two affiliates for the year 2015 was as follows:

-What amount of unrealized profit did Pelga Company have at the end of 2015?

A) $10,000

B) $12,500

C) $50,000

D) $62,500

Correct Answer:

Verified

Correct Answer:

Verified

Q24: A(n)_ sale is a sale by a

Q25: Assume there are routine inventory sales between

Q26: Preen Corporation acquired a 60% interest in

Q27: Use the following information to answer the

Q28: Use the following information to answer the

Q30: Papal Corporation acquired an 80% interest in

Q31: Use the following information to answer the

Q32: Pirate Transport bought 80% of the outstanding

Q33: Pexo Industries purchases the majority of their

Q34: Psalm Enterprises owns 90% of the outstanding