Essay

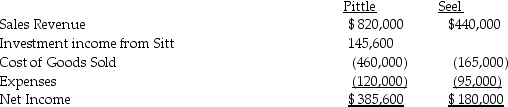

Pittle Corporation acquired an 80% interest in Seel Corporation at a cost equal to 80% of the book value of Seel's net assets several years ago.At the time of purchase,the fair value and book value of Seel's assets and liabilities were equal.Pittle purchases its entire inventory from Seel at 150% of Seel's cost.During 2014,Seel sold $490,000 of merchandise to Pittle.Pittle's beginning and ending inventories for 2014 were $72,000 and $66,000,respectively.Income statement information for both companies for 2014 is as follows:

Required:

Required:

Prepare a consolidated income statement for Pittle Corporation and Subsidiary for 2014.

Correct Answer:

Verified

Preliminary computations:

Unrealized pro...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Unrealized pro...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Proman Manufacturing owns a 90% interest in

Q17: Use the following information to answer the

Q18: Plateau Incorporated bought 60% of the common

Q19: Use the following information to answer the

Q20: The material sale of inventory items by

Q22: Use the following information to answer the

Q23: A parent company regularly sells merchandise to

Q24: A(n)_ sale is a sale by a

Q25: Assume there are routine inventory sales between

Q26: Preen Corporation acquired a 60% interest in