Essay

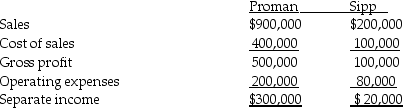

Proman Manufacturing owns a 90% interest in Sipp Company,purchased at a time when the book values of Sipp's recorded assets and liabilities were equal to fair values.During 2014,Sipp sold merchandise to Proman for $80,000 at a 20% gross profit.At December 31,2014,25% of this merchandise is still in Proman's inventory.Separate incomes for Proman and Sipp are summarized as follows:

Required: Prepare a consolidated income statement for 2014 for Proman and subsidiary.

Required: Prepare a consolidated income statement for 2014 for Proman and subsidiary.

Correct Answer:

Verified

Consolidated cost of goods s...

Consolidated cost of goods s...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: If a subsidiary is a 100 percent-owned

Q12: PreBuild Manufacturing acquired 100% of Shoding Industries

Q13: Plover Corporation acquired 80% of Sink Inc.equity

Q14: Paulee Corporation paid $24,800 for an 80%

Q15: The elimination entry for unrealized profit is

Q17: Use the following information to answer the

Q18: Plateau Incorporated bought 60% of the common

Q19: Use the following information to answer the

Q20: The material sale of inventory items by

Q21: Pittle Corporation acquired an 80% interest in