Essay

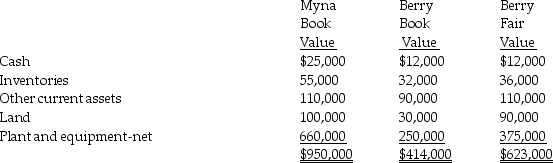

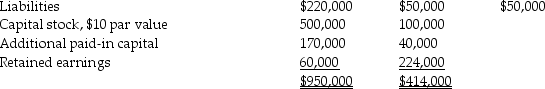

On January 1,2014,Myna Corporation issued 10,000 shares of its own $10 par value common stock for 9,000 shares of the outstanding stock of Berry Corporation in an acquisition.Myna common stock at January 1,2014 was selling at $70 per share.Just before the business combination,balance sheet information of the two corporations was as follows:

Required:

Required:

1.Prepare the journal entry on Myna Corporation's books to account for the investment in Berry Company.

2.Prepare a consolidated balance sheet for Myna Corporation and Subsidiary immediately after the business combination.

Correct Answer:

Verified

Requirement 1:

Requirement 2...

Requirement 2...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: In the consolidated income statement of Wattlebird

Q13: Panini Corporation owns 85% of the outstanding

Q14: Push-down accounting is the process of recording

Q15: A corporation becomes a subsidiary when another

Q16: A newly acquired subsidiary had pre-existing goodwill

Q18: Pregler Inc.has 70% ownership of Sach Company,but

Q19: Push-down accounting<br>A)requires a subsidiary to use the

Q20: Pool Industries paid $540,000 to purchase 75%

Q21: Polaris Incorporated purchased 80% of The Solar

Q22: A parent's income from subsidiary investments can