Essay

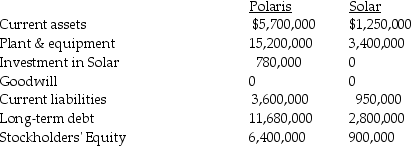

Polaris Incorporated purchased 80% of The Solar Company on January 2,2014,when Solar's book value was $800,000.Polaris paid $700,000 for their acquisition,and the fair value of noncontrolling interest was $175,000.At the date of acquisition,the fair value and book value of Solar's identifiable assets and liabilities were equal.At the end of the year,the separate companies reported the following balances:

Requirement 1: Calculate consolidated balances for each of the accounts as of December 31,2014.

Requirement 1: Calculate consolidated balances for each of the accounts as of December 31,2014.

Requirement 2: Assuming that Solar has paid no dividends during the year,what is the ending balance of the noncontrolling interest in the subsidiary?

Correct Answer:

Verified

Requirement 1:

Current Assets = $5,700,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Current Assets = $5,700,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: A newly acquired subsidiary had pre-existing goodwill

Q17: On January 1,2014,Myna Corporation issued 10,000 shares

Q18: Pregler Inc.has 70% ownership of Sach Company,but

Q19: Push-down accounting<br>A)requires a subsidiary to use the

Q20: Pool Industries paid $540,000 to purchase 75%

Q22: A parent's income from subsidiary investments can

Q23: The excess of fair value over book

Q24: Pal Corporation paid $5,000 for a 60%

Q25: On January 2,2014,Power Incorporated paid $630,000 for

Q26: Petra Corporation paid $500,000 for 80% of