Essay

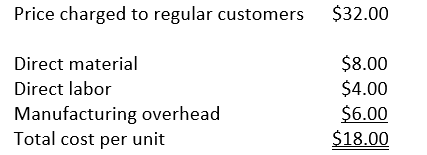

Lakeside Industries’ operates as a decentralized organization. Its tent division manufactures small camping tents. The fabricating division manufactures one component needed by the tent division. The tent division has been purchasing the component from an outside supplier, but top management has conducted a study and believes the company could substantially cut costs by all divisions purchasing any components made by other divisions from lakeside rather than an outside source. Detailed unit cost for the fabricating component needed to make tents is given below:

The manufacturing overhead is 60% fixed and 40% variable.

Required:

c. What is the transfer price if Lakeside uses the market-based price?

d. What is the minimum transfer price?

Correct Answer:

Verified

c.$32.00

d...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

d...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: If a cost is incurred specifically for

Q94: The Logan Company reported the following operating

Q96: An organization may be structured as a

Q98: In a responsibility accounting environment, upper managers

Q99: Although a profit center is expected to

Q100: Nobles Corporation provided the following income statement

Q103: ABC Corporation's North Division generates operating income

Q109: Although managers' actions may improve ROI in

Q159: If you think of an organization's structure

Q190: Return on investment measures the rate of