Essay

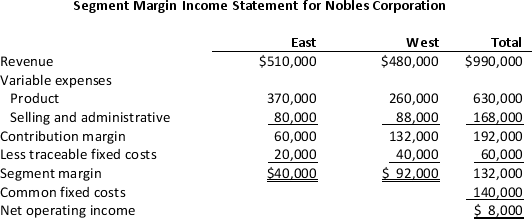

Nobles Corporation provided the following income statement for two of its divisions: East and West.

Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets $60,000 current and $240,000 long-term and $320,000 of liabilities $120,000 current and $200,000 long-term.The West division reported $360,000 of assets $80,000 current and $280,000 long-term and $260,000 of liabilities $60,000 current and $200,000 long-term.

Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets $60,000 current and $240,000 long-term and $320,000 of liabilities $120,000 current and $200,000 long-term.The West division reported $360,000 of assets $80,000 current and $280,000 long-term and $260,000 of liabilities $60,000 current and $200,000 long-term.

a.Calculate the economic value added for each division.

b.Which of the two managers will be rated higher on performance? Why?

Correct Answer:

Verified

a. EVA calculations for East and West:

E...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

E...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: If a cost is incurred specifically for

Q96: An organization may be structured as a

Q98: In a responsibility accounting environment, upper managers

Q99: Lakeside Industries’ operates as a decentralized organization.

Q99: Although a profit center is expected to

Q103: ABC Corporation's North Division generates operating income

Q105: Durango Corporation's Midwestern region operates as an

Q109: Although managers' actions may improve ROI in

Q159: If you think of an organization's structure

Q190: Return on investment measures the rate of