Multiple Choice

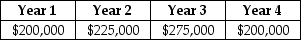

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $420,000. The Sisyphean Company expects cash inflows from this project as detailed below:  The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.

The net present value (NPV) for this project is closest to ________.

A) $206,265

B) $144,385

C) $515,661

D) $216,578

Correct Answer:

Verified

Correct Answer:

Verified

Q30: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" -You are trying

Q31: A company buys a color printer that

Q32: Consider a project with the following cash

Q33: Two mutually exclusive investment opportunities require an

Q34: Which of the following statements is FALSE?<br>A)

Q36: You can evaluate alternative projects with different

Q37: You are opening up a brand new

Q38: What is the decision criterion using the

Q39: The Sisyphean Company is planning on investing

Q40: Which of the following is NOT a