Multiple Choice

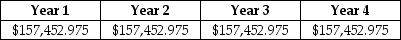

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $400,000. The Sisyphean Company expects cash inflows from this project as detailed below:  The appropriate discount rate for this project is 15%. The internal rate of return (IRR) for this project is closest to ________.

The appropriate discount rate for this project is 15%. The internal rate of return (IRR) for this project is closest to ________.

A) 13%

B) 16%

C) 21%

D) 24%

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Which of the following statements is FALSE?<br>A)

Q35: The Sisyphean Company is planning on investing

Q36: You can evaluate alternative projects with different

Q37: You are opening up a brand new

Q38: What is the decision criterion using the

Q40: Which of the following is NOT a

Q41: According to Graham and Harvey's 2001 survey

Q42: Which of the following decision rules might

Q44: A janitorial services firm is considering two

Q45: Use the table for the question(s)below.<br>Consider the