Multiple Choice

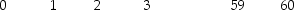

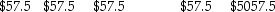

+---------+---------+---------+----- . . . -------+---------+

+---------+---------+---------+----- . . . -------+---------+ A corporation issues a bond that generates the above cash flows. If the periods are of 3-month intervals, which of the following best describes that bond?

A corporation issues a bond that generates the above cash flows. If the periods are of 3-month intervals, which of the following best describes that bond?

A) a 15-year bond with a notional value of $5000 and a coupon rate of 4.6% paid quarterly

B) a 15-year bond with a notional value of $5000 and a coupon rate of 1.2% paid annually

C) a 30-year bond with a notional value of $5000 and a coupon rate of 3.5% paid semiannually

D) a 60-year bond with a notional value of $5000 and a coupon rate of 4.6% paid quarterly

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Consider the following yields to maturity on

Q10: Which of the following statements regarding bonds

Q11: How are investors in zero-coupon bonds compensated

Q12: Use the figure for the question(s) below.

Q13: What is the dirty price of a

Q15: Use the figure for the question(s) below.

Q16: Use the information for the question(s) below.

Q17: Consider a zero-coupon bond with a $1000

Q18: What is the yield to maturity of

Q19: Which of the following statements regarding bonds