Multiple Choice

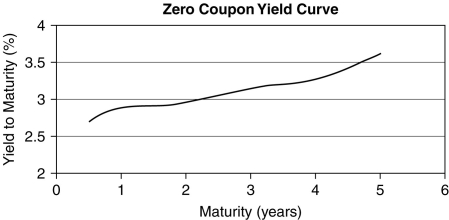

Use the figure for the question(s) below.

-A risk-free, zero-coupon bond with a face value of $10,000 has 15 years to maturity. If the YTM is 6.1%, which of the following would be closest to the price this bond will trade at?

A) $4937

B) $5760

C) $6582

D) $4114

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Which of the following statements regarding bonds

Q11: How are investors in zero-coupon bonds compensated

Q12: Use the figure for the question(s) below.

Q13: What is the dirty price of a

Q14: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" +---------+---------+---------+----- . .

Q16: Use the information for the question(s) below.

Q17: Consider a zero-coupon bond with a $1000

Q18: What is the yield to maturity of

Q19: Which of the following statements regarding bonds

Q20: Which of the following best shows the