Multiple Choice

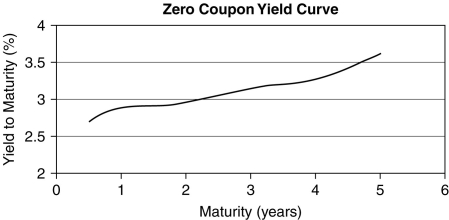

Use the figure for the question(s) below.

-A risk-free, zero-coupon bond has 15 years to maturity. Which of the following is closest to the price per $1000 of face value that the bond will trade at if the YTM is 6.1%?

A) $663.78

B) $774.42

C) $553.15

D) $885.05

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Prior to its maturity date, the price

Q48: A $1000 bond with a coupon rate

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" The above table

Q50: A five-year bond with a $1,000 face

Q51: Which of the following statements is true

Q53: Luther Industries needs to raise $25 million

Q54: Use the information for the question(s) below.

Q55: What is the yield to maturity of

Q56: Use the information for the question(s) below.

Q57: Bonds with a high risk of default