Multiple Choice

Use the information for the question(s) below.

-The Sisyphean Company has a bond outstanding with a face value of $5000 that reaches maturity in 8 years. The bond certificate indicates that the stated coupon rate for this bond is 8.2% and that the coupon payments are to be made semiannually. Assuming that this bond trades for $4541.53, then the YTM for this bond is closest to ________.

A) 7.9%

B) 11.9%

C) 13.8%

D) 9.9%

Correct Answer:

Verified

Correct Answer:

Verified

Q51: Which of the following statements is true

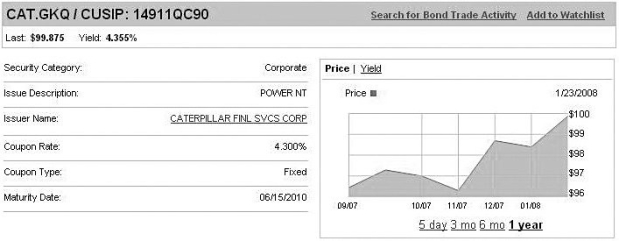

Q52: Use the figure for the question(s) below.

Q53: Luther Industries needs to raise $25 million

Q54: Use the information for the question(s) below.

Q55: What is the yield to maturity of

Q57: Bonds with a high risk of default

Q58: The coupon value of a bond is

Q59: What is the coupon payment of a

Q60: Use the information for the question(s) below.

Q61: Consider the following yields to maturity on