Multiple Choice

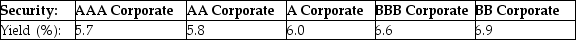

Lloyd Industries raised $28 million in order to upgrade its roller kiln furnace for the production of ceramic tiles. The company funded this by issuing 15-year bonds with a face value of $1,000 and a coupon rate of 6.2%, paid annually. The above table shows the yield to maturity for similar 15-year corporate bonds of different ratings issued at the same time. When Lloyd Industries issued their bonds, they received a price of $962.63. Which of the following is most likely to be the rating these bonds received?

Lloyd Industries raised $28 million in order to upgrade its roller kiln furnace for the production of ceramic tiles. The company funded this by issuing 15-year bonds with a face value of $1,000 and a coupon rate of 6.2%, paid annually. The above table shows the yield to maturity for similar 15-year corporate bonds of different ratings issued at the same time. When Lloyd Industries issued their bonds, they received a price of $962.63. Which of the following is most likely to be the rating these bonds received?

A) AA

B) A

C) BBB

D) BB

Correct Answer:

Verified

Correct Answer:

Verified

Q58: The coupon value of a bond is

Q59: What is the coupon payment of a

Q60: Use the information for the question(s) below.

Q61: Consider the following yields to maturity on

Q62: Consider the following yields to maturity on

Q64: A corporate bond makes payments of $9.67

Q65: Before it matures, the price of any

Q66: Treasury bonds have original maturities from one

Q67: A 20-year bond with a $1,000 face

Q68: Under what situation should the clean price,