Multiple Choice

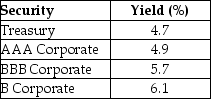

Consider the following yields to maturity on various one-year, zero-coupon securities:  The credit spread of the B corporate bond is closest to ________.

The credit spread of the B corporate bond is closest to ________.

A) 1.4%

B) 1.70%

C) 2.80%

D) 0.70%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q56: Use the information for the question(s) below.

Q57: Bonds with a high risk of default

Q58: The coupon value of a bond is

Q59: What is the coupon payment of a

Q60: Use the information for the question(s) below.

Q62: Consider the following yields to maturity on

Q63: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" Lloyd Industries raised

Q64: A corporate bond makes payments of $9.67

Q65: Before it matures, the price of any

Q66: Treasury bonds have original maturities from one