Multiple Choice

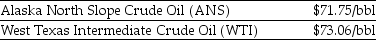

Use the information for the question(s) below.  As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Another oil refiner is offering to trade you  of Alaska North Slope (ANS) crude oil for

of Alaska North Slope (ANS) crude oil for  of West Texas Intermediate (WTI) crude oil. Assuming you just purchased

of West Texas Intermediate (WTI) crude oil. Assuming you just purchased  of WTI crude at the current market price, the total revenue (cost) to you if you take the trade is closest to ________.

of WTI crude at the current market price, the total revenue (cost) to you if you take the trade is closest to ________.

A) $755,650

B) $766,150

C) $767,600

D) $776,650

Correct Answer:

Verified

Correct Answer:

Verified

Q91: Which of the following is the overarching

Q92: A wholesale food retailer is offered $15.60

Q93: What is the future value (FV) of

Q94: On the day Harry was born, his

Q95: Use the information for the question(s) below.<br>

Q97: Heavy Duty Company, a manufacturer of power

Q98: Why should you approach every problem by

Q99: To compute the future value of a

Q100: Whose cash flow is best described by

Q101: Which of the following statements regarding the