Multiple Choice

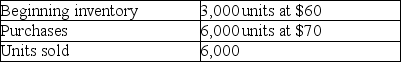

Given the following data,by how much would taxable income change if LIFO is used rather than FIFO?

A) There is no difference.

B) Increase by $30,000

C) Decrease by $30,000

D) Decrease by $40,000

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Scott Walker Company has the following data

Q48: In 2015,ending inventory is overstated.What is the

Q49: Beginning inventory and ending inventory have opposite

Q49: When comparing the results of LIFO and

Q50: Carboni Company had the following data available

Q52: Using a perpetual inventory system,what journal entry(ies)is(are)prepared

Q64: When inventory costs are rising,a company using

Q85: When inventory costs are falling,which inventory costing

Q119: If ending inventory is overstated by $6,000,then:<br>A)stockholders'

Q141: The LIFO Reserve is the difference between