Essay

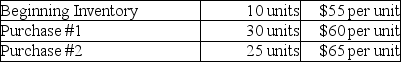

Carboni Company had the following data available for the current month:

Assume 40 units were sold during the month.Sales Revenue for the month is $7,000 and operating expenses are $2,200.The income tax rate is 30%.

Assume 40 units were sold during the month.Sales Revenue for the month is $7,000 and operating expenses are $2,200.The income tax rate is 30%.

Required:

1.Compute Cost of Goods Sold using:

a.FIFO

b.LIFO

2.How much would Carboni Company save in income taxes if they used LIFO instead of FIFO?

Correct Answer:

Verified

1.a.FIFO Cost of Goo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: Given the following data,by how much would

Q48: In 2015,ending inventory is overstated.What is the

Q49: When comparing the results of LIFO and

Q49: Beginning inventory and ending inventory have opposite

Q52: Using a perpetual inventory system,what journal entry(ies)is(are)prepared

Q53: Kennel Company reported the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4004/.jpg"

Q54: A fire destroyed the inventory and store

Q55: Which statement is TRUE?<br>A)Most companies use the

Q64: When inventory costs are rising,a company using

Q119: If ending inventory is overstated by $6,000,then:<br>A)stockholders'