Essay

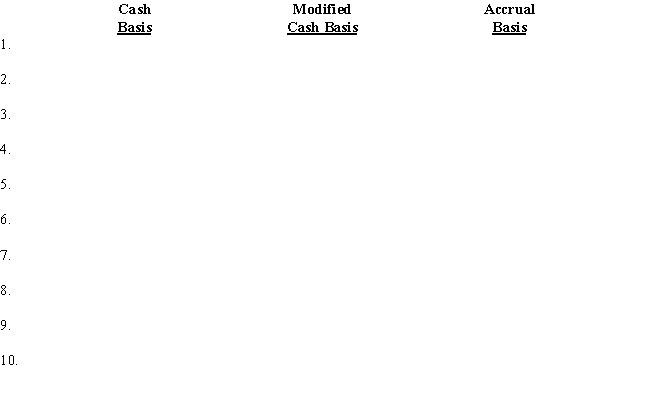

In the columns below,insert the entry that would be made for each transaction under each accounting basis,using appropriate debit and credit account titles.

1. Purchased equipment on account

2. Paid cash for new equipment.

3. Purchased one-year insurance policy for cash.

4. Received bill for electricity.

5. Performed services for cash.

6. Performed services on account.

7. Paid cash for wages.

8. Paid for equipment purchased on account.

9. Depreciation on equipment.

10. Supplies are partly used.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Adjusting entries may affect the cash account.

Q3: A method of accounting under which revenues

Q4: The period of time that an asset

Q5: What does the credit balance in the

Q6: Supplies originally cost $600,but only $150 worth

Q7: The cost of plant assets less the

Q8: Adjusting entries does not always affect both

Q9: The amount of depreciation taken each period

Q10: The modified cash basis of accounting combines

Q11: The 10-column work sheet is used to