Essay

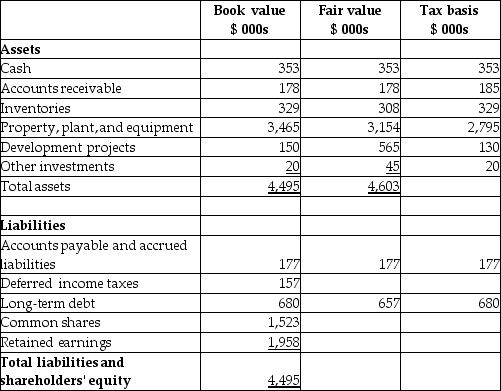

On January 1, 20X7, Falcon acquired 100% of the outstanding shares of Intra for $3,600,000. Both are mining companies involved in nickel and copper production. The balance sheet for Intra at the date of acquisition is shown below, together with estimates of the fair values and tax values of Intra's recorded assets and liabilities.

Intra Corp

Statement of Financial Position

December 31, 20X 6  The tax rate for Intra and for Falcon is 30%.

The tax rate for Intra and for Falcon is 30%.

Required:

What is the amount of goodwill to be recorded for this business combination?

Correct Answer:

Verified

Deferred income taxes

Deferred income taxes

Temporary differe...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Temporary differe...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions