Multiple Choice

Answer the following questions using the information below:

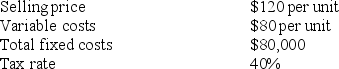

Assume the following cost information for Fernandez Company:

-If Bel Air Realtor plans an operating income of $210,000 and the tax rate is 30%, then Bel Air's planned net income should be:

A) $63,000

B) $147,000

C) $273,000

D) $357,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Answer the following questions using the information

Q3: Answer the following questions using the information

Q7: Mrs. Tannenbaum is going to sell Christmas

Q8: Breakeven point is that quantity of output

Q9: Cost-volume-profit analysis assumes all of the following

Q10: Answer the following questions using the information

Q11: Answer the following questions using the information

Q85: The degree of operating leverage at a

Q121: Furniture, Inc., sells lamps for $30. The

Q176: If variable costs per unit increase, then