Essay

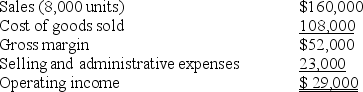

Moore Company prepared the following absorption-costing income statement for the year ended May 31, 2011.

Additional information follows:

Additional information follows:

Selling and administrative expenses include $1.50 of variable cost per unit sold. There was no beginning inventory, and 8,750 units were produced. Variable manufacturing costs were $11 per unit. Actual fixed costs were equal to budgeted fixed costs.

Required:

Prepare a variable-costing income statement for the same period.

Correct Answer:

Verified

Variable ...

Variable ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Throughput costing considers only direct materials and

Q198: To discourage producing for inventory, management can:<br>A)evaluate

Q199: Absorption costing is required for all of

Q200: _ method(s)include(s)fixed manufacturing overhead costs as inventoriable

Q201: At the end of the accounting period

Q203: The gross-margin format of the income statement:<br>A)is

Q204: Theoretical capacity is the capacity level that

Q205: The gross-margin format of the income statement

Q206: The production-volume variance is affected by the

Q207: When the unit level of inventory decreases