Multiple Choice

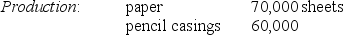

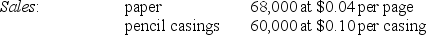

Yakima Manufacturing purchases trees from Cheney Lumber and processes them up to the splitoff point where two products (paper and pencil casings) are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of May:

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 70,000 sheets of paper and 60,000 pencil casings is $3,000.

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 70,000 sheets of paper and 60,000 pencil casings is $3,000.

Yakima's Manufacturing's accounting department reported no beginning inventories and an ending inventory of 2,000 sheets of paper.

What are the paper's and the pencils' approximate weighted cost proportions using the sales value at splitoff method, respectively?

A) 50.00% and 50.00%

B) 33.33% and 66.67%

C) 31.82% and 68.18%

D) None of these answers is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Which method of accounting recognizes byproducts in

Q43: Which of the methods of allocating joint

Q44: Joint costs are NOT allocated to individual

Q47: All of the following methods may be

Q48: The estimated net realizable value method is

Q50: The production method of accounting for byproducts

Q51: Red Sauce Canning Company processes tomatoes into

Q100: The constant gross-margin percentage NRV method is

Q126: What type of cost is the result

Q134: The juncture in a joint production process