Essay

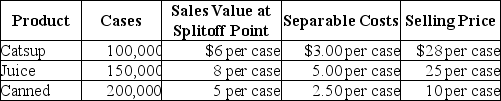

Red Sauce Canning Company processes tomatoes into catsup, tomato juice, and canned tomatoes. During the summer of 20X5, the joint costs of processing the tomatoes were $420,000. There was no beginning or ending inventories for the summer. Production and sales value information for the summer is as follows:

Required:

Required:

Determine the amount allocated to each product if the estimated net realizable value method is used, and compute the cost per case for each product.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Yakima Manufacturing purchases trees from Cheney Lumber

Q47: All of the following methods may be

Q48: The estimated net realizable value method is

Q50: The production method of accounting for byproducts

Q52: Which statement is NOT true regarding the

Q53: Which of the following is NOT a

Q54: Litigation may be a reason that joint

Q56: All costs incurred beyond the splitoff point

Q84: Separable costs include manufacturing costs only.

Q134: The juncture in a joint production process