Essay

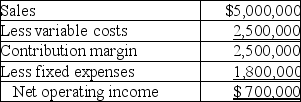

LaserLife Printer Cartridge Company is a decentralized organization with several autonomous divisions. The division managers are evaluated, in part, on the basis of the change in their return on invested assets. Operating results for the Packer Division for 20X5 are budgeted as follows:

Operating assets for the division are currently $3,600,000. For 20X5, the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60% of the selling price.

Operating assets for the division are currently $3,600,000. For 20X5, the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60% of the selling price.

Required:

a. What is the effect on ROI of accepting the new product line?

b. If the company's required rate of return is 6% and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

Correct Answer:

Verified

a.

Current ROI = $700,000/$3,600,000 =...

Current ROI = $700,000/$3,600,000 =...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: Companies are increasingly using nonfinancial measures to

Q39: Answer the following questions using the

Q52: Capital Investments has three divisions. Each division's

Q53: Comparing the performance of divisions of a

Q55: The residual income method is the most

Q56: Thacker Company has two regional offices. The

Q60: Companies that adopt the Economic Value Added

Q61: Answer the following questions using the information

Q62: A negative feature of defining investment by

Q99: Answer the following questions using the