Essay

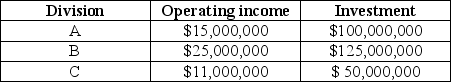

Capital Investments has three divisions. Each division's required rate of return is 15%. Planned operating results for 20X5 are as follows:

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a. Compute the current ROI for each division.

b. Compute the current residual income for each division.

c. Rank the divisions according to their current ROIs and residual incomes.

d. Determine the effects after adding the new project to each division's ROI and residual income.

e. Assuming the managers are evaluated on either ROI or residual income, which divisions are pleased with the expansion and which ones are unhappy?

Correct Answer:

Verified

Correct Answer:

Verified

Q48: Answer the following questions using the information

Q49: R&D Storage is a small, but diversified,

Q50: Consolidated Gas Supply Corporation uses the investment

Q51: The three alternatives for increasing return on

Q53: Comparing the performance of divisions of a

Q55: The residual income method is the most

Q56: Thacker Company has two regional offices. The

Q57: LaserLife Printer Cartridge Company is a decentralized

Q63: Current cost return on investment is a

Q99: Answer the following questions using the