Multiple Choice

Use the information below to answer the following question(s) .

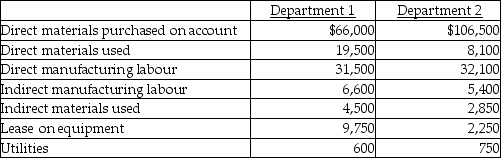

Jim's Computer Products manufactures keyboards for computers. In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2. The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively. For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2. The company uses a budgeted departmental overhead rate for applying overhead to production.

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2. The company uses a budgeted departmental overhead rate for applying overhead to production.

-In the service sector,

A) direct labour costs are always easy to trace to jobs.

B) a budgeted direct labour cost rate may be used to apply direct labour to jobs.

C) normal costing may not be used.

D) overhead is always applied using an actual cost allocation rate.

E) cost of goods sold includes beginning service inventory.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Use the information below to answer the

Q33: Actual costing traces direct costs to a

Q62: It is not a requirement to identify

Q63: Sambell Manufacturing uses a predetermined manufacturing overhead

Q64: A wholesale automobile company that buys and

Q106: A local engineering firm is bidding on

Q132: Fixed and variable costs may be allocated

Q147: A local attorney employs ten full-time professionals.The

Q158: Process costing is a useful system for

Q185: What is the difference between an actual