Essay

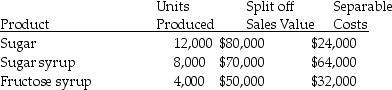

Sweet Sugar Company processes sugar beets into three products. During April the joint costs of processing were $240,000. Production and sales value information for the month were as follows:

Sales Value at

Required:

Required:

Determine the amount of joint cost allocated to each product if the sales value at split off method is used.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Answer the following question(s)using the information below.The

Q17: What type of cost is the result

Q48: Separable costs are assignable after the splitoff

Q116: Use the information below to answer the

Q120: Distinguish between the two principal methods of

Q126: Answer the following question(s) using the information

Q128: Which of the following is NOT a

Q129: If joint products end up with the

Q135: Use the information below to answer the

Q143: The estimated net realizable method allocates joint