Multiple Choice

Answer the following question(s) using the information below:

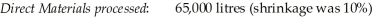

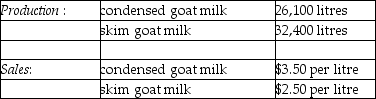

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-Which method of allocating costs would be used if the selling prices of all products at the splitoff point are unavailable?

A) sales value at splitoff method

B) NRV method

C) physical measures method

D) constant gross-margin percentage method

E) reciprocal method

Correct Answer:

Verified

Correct Answer:

Verified

Q17: What type of cost is the result

Q115: The net realizable value method is generally

Q116: Use the information below to answer the

Q121: Chem Manufacturing Company processes direct materials up

Q123: BC Lumber processes timber into four products.

Q125: For each of the following items tell

Q128: Which of the following is NOT a

Q129: If joint products end up with the

Q131: Sweet Sugar Company processes sugar beets into

Q152: All of the following changes may indicate