Multiple Choice

Answer the following question(s) using the information below:

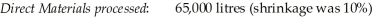

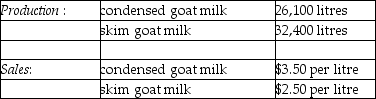

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-How much (if any) extra income would Morton earn if it produced and sold all of the Xyla from the condensed goat milk? Allocate joint processing costs based upon relative sales value on the splitoff. (Extra income means income in excess of what Morton would have earned from selling condensed goat milk.)

A) $53,063

B) $254,213

C) $201,150

D) $96,787

E) $259,650

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Use the information below to answer the

Q26: Use the information below to answer the

Q34: Answer the following question(s) using the information

Q36: Peachland Fruit Ltd. harvests blueberries. After harvest,

Q38: Assigning joint costs when only a portion

Q40: If managers make processing or selling decisions

Q47: Use the information below to answer the

Q51: Use the information below to answer the

Q133: There are no logical reasons for allocating

Q170: Net realizable value generally means expected sales