Multiple Choice

Use the information below to answer the following question(s) .

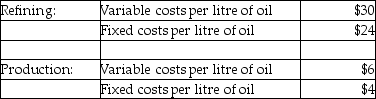

Blackoil Corp. has two divisions, Refining and Production. The company's primary product is Clean Oil. Each division's costs are provided below:

The Production Division is able to sell the oil to other areas for $24 per litre. The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers. The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre. The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers. The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

-Division A sells soybean paste internally to Division B, which, in turn, produces soybean burgers that sell for $5 per kilogram. Division A incurs costs of $0.75 per kilogram, while Division B incurs additional costs of $2.50 per kilogram. Which of the following formulas correctly reflects the company's operating income per kilogram?

A) $5.00 - ($0.75 +$2.50) = $1.75

B) $5.00 - ($1.25 +$2.50) = $1.25

C) $5.00 - ($0.75 +$3.75) = $0.50

D) $5.00 - ($0.25 +$1.25 +$3.50) = 0

E) $5.00 - ($0.25 +$1.25 +$1.50) = $2.00

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Full-cost transfer pricing may be used because

Q9: Answer the following question(s)using the information below.Cool

Q29: Answer the following question(s)using the information below.Cool

Q44: A company has two divisions.The Bottle Division

Q88: The choice of a transfer-pricing method has

Q122: The Surrey Division of Columbia Ltd. has

Q123: The objectives of setting transfer prices include<br>A)

Q128: When companies are unable to choose a

Q130: A management control system is a means

Q131: Centralia Components Ltd. manufactures cable assemblies used