Multiple Choice

Use the information below to answer the following question(s) .

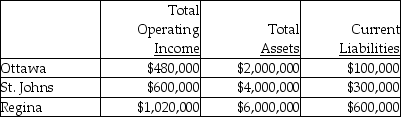

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million) . The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for St. Johns?

A) $142,200

B) $190,600

C) $163,200

D) $200,000

E) $145,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: National Can Company has three divisions, Eastern,

Q14: Hargrave Products has three divisions which operate

Q47: Comparing the performance of divisions of a

Q49: Return on sales is calculated by dividing

Q76: Which of the following performance measures is

Q103: _ and _ would be uncontrollable factors

Q118: Measures which monitor critical performance variables that

Q128: An important consideration in designing compensation arrangements

Q147: A company has total assets of $500,000,

Q164: _ describes contexts in which, once risk