Essay

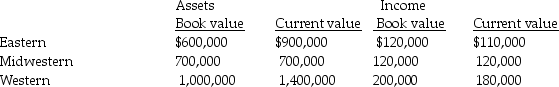

National Can Company has three divisions, Eastern, Midwestern, and Western. Because of very different accounting methods and inflation rates in different countries it is considering multiple evaluation measures. Information gathered about the divisions for the year just ended follows:  The company is currently using a required rate of return of 15 percent.

The company is currently using a required rate of return of 15 percent.

Required:

A) Compute the ROI using both book value and current value for all divisions. Round to three decimal places.

B) Compute residual income using book value and current value for all divisions.

C) Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

Correct Answer:

Verified

A.

Book value ROI: Eastern = $120,000/$6...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Book value ROI: Eastern = $120,000/$6...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Use the information below to answer the

Q14: Hargrave Products has three divisions which operate

Q16: Batman Abstract Company has three divisions that

Q43: The "four levers" of control are operating

Q47: Comparing the performance of divisions of a

Q49: Return on sales is calculated by dividing

Q76: Which of the following performance measures is

Q92: Deciding if all subunits should have the

Q128: An important consideration in designing compensation arrangements

Q147: A company has total assets of $500,000,