Essay

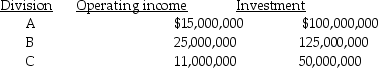

Capital Investments has three divisions. Each division's required rate of return is 15 percent. Planned operating results for 2011 are:

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a. Compute the current ROI for each division.

b. Compute the current residual income for each division.

c. Rank the divisions according to their current ROIs and residual incomes.

d. Determine the effects after adding the new project to each division's ROI and residual income.

e. Which Divisions are pleased with the addition and which ones are unhappy assuming the managers are evaluated on a combination of ROI and residual income? Is a combination of ROI and residual income appropriate for the divisions?

Correct Answer:

Verified

a. A ROI = $15,000,000/$100,000,000 = 0....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: Economic value added is after-tax operating income

Q68: Which type of compensation is most prevalent

Q77: There are three basic ingredients in profitability:

Q78: Use the information below to answer the

Q81: Investment turnover is calculated by dividing investments

Q87: Holmes Electronics Ltd. has three divisions: Resistors,

Q99: Chaucer Ltd.has current assets of $450,000 and

Q145: The imputed cost of an investment is

Q146: In establishing performance measures and compensation policy,

Q158: The Auto Division of Fran Corporation has