Essay

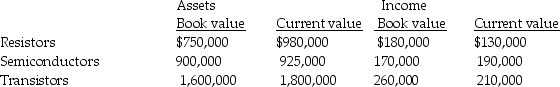

Holmes Electronics Ltd. has three divisions: Resistors, Semiconductors and Transistors, each located in a different geographic region. Data for its most recent year are presented below:  The company is currently using a required rate of return of 16 percent.

The company is currently using a required rate of return of 16 percent.

Required:

A) Compute the ROI using both book value and current value for all divisions. Round to four decimal places.

B) Compute residual income using book value and current value for all divisions.

C) Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

Correct Answer:

Verified

A.

Book value ROI: Resistors = $180,000/...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Book value ROI: Resistors = $180,000/...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: Economic value added is after-tax operating income

Q68: Which type of compensation is most prevalent

Q82: Capital Investments has three divisions. Each division's

Q83: Current cost is the cost of purchasing

Q91: Which of the following statements is true?<br>A)

Q92: The Irnakk Corporation manufactures iPod covers in

Q96: A corporation has a required rate of

Q138: Answer the following question(s)using the information below:<br>Carriage

Q145: The imputed cost of an investment is

Q158: The Auto Division of Fran Corporation has