Essay

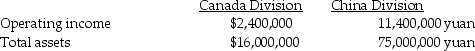

The Irnakk Corporation manufactures iPod covers in Canada and China. The operations are organized as decentralized divisions. The following information is available for the year just ended:

The exchange rate at the time of Irnakk's investment (the end of the previous year) in China was 7.5 Chinese yuan = $1 Canadian. During the year, the yuan declined steadily in value and the exchange rate at the end of the current year was 8.5 yuan = $1 Canadian. The average exchange rate during the year was 8 yuan = $1 Canadian.

The exchange rate at the time of Irnakk's investment (the end of the previous year) in China was 7.5 Chinese yuan = $1 Canadian. During the year, the yuan declined steadily in value and the exchange rate at the end of the current year was 8.5 yuan = $1 Canadian. The average exchange rate during the year was 8 yuan = $1 Canadian.

Required:

a. Calculate the Canadian Division's ROI for last year based on dollars.

b. Calculate the Chinese Division's ROI for last year based on yuan.

c. Which of Irnakk's two divisions earned the better ROI? Explain your answer, complete with supporting calculations.

Correct Answer:

Verified

a. Canadian Division's ROI for the year ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: Current cost is defined as the cost

Q83: Current cost is the cost of purchasing

Q87: Holmes Electronics Ltd. has three divisions: Resistors,

Q91: Which of the following statements is true?<br>A)

Q96: A corporation has a required rate of

Q96: Answer the following question(s) using the information

Q97: Answer the following question(s) using the information

Q134: Managers use _ to create an ongoing

Q138: Answer the following question(s)using the information below:<br>Carriage

Q144: Use the information below to answer the