Multiple Choice

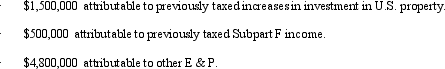

Steve, Inc., a U.S. shareholder owns 100% of a CFC from which Steve receives a $3 million cash distribution. The CFC's E & P is composed of the following amounts.  Steve recognizes a taxable dividend of:

Steve recognizes a taxable dividend of:

A) $3 million.

B) $2 million.

C) $1.5 million.

D) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Old,Inc. ,a U.S.corporation,earns foreign-source income classified in

Q35: OutCo, a controlled foreign corporation owned 100%

Q43: With respect to income generated by non-U.S.

Q80: Which of the following statements concerning the

Q121: ForCo, a foreign corporation, receives interest income

Q122: Given the following information, determine whether Greta,

Q123: Match the definition with the correct term.<br>

Q126: Which of the following statements regarding translation

Q129: Which of the following income items does

Q130: ForCo, a foreign corporation not engaged in