Essay

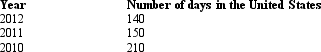

Given the following information, determine whether Greta, an alien, is a U.S. resident for 2012. Assume that Greta cannot establish a tax home in or a closer connection to a foreign country.

Correct Answer:

Verified

For Federal income tax purposes, Greta i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Freiburg, Ltd., a foreign corporation, operates a

Q2: A Qualified Business Unit of a U.S.

Q2: Old,Inc. ,a U.S.corporation,earns foreign-source income classified in

Q12: Wood, a U.S.corporation, owns Holz, a German

Q43: With respect to income generated by non-U.S.

Q80: Which of the following statements concerning the

Q121: ForCo, a foreign corporation, receives interest income

Q123: Match the definition with the correct term.<br>

Q125: Steve, Inc., a U.S. shareholder owns 100%

Q126: Which of the following statements regarding translation