Multiple Choice

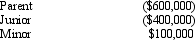

The Philstrom consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss (NOL) that is apportioned to Junior.

A) $0. All NOLs of a consolidated group are apportioned to the parent.

B) $300,000.

C) $360,000.

D) $400,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Outline the major advantages and disadvantages of

Q38: Consolidated group members each are jointly and

Q47: Consolidated estimated tax payments must begin for

Q79: Conformity among the members of a consolidated

Q82: The consolidated income tax return rules apply

Q83: Cooper Corporation joined the Duck consolidated Federal

Q86: ParentCo and SubCo had the following items

Q87: In terms of the consolidated return rules,

Q88: Keep Corporation joined an affiliated group by

Q89: ParentCo acquired all of the stock of