Multiple Choice

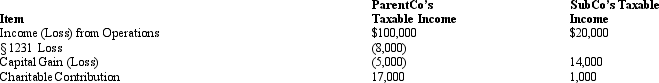

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $107,000.

B) $108,000.

C) $108,900.

D) $115,800.

E) $121,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Outline the major advantages and disadvantages of

Q9: The rules can limit the net operating

Q38: Consolidated group members each are jointly and

Q82: The consolidated income tax return rules apply

Q83: Cooper Corporation joined the Duck consolidated Federal

Q84: The Philstrom consolidated group reported the following

Q87: In terms of the consolidated return rules,

Q88: Keep Corporation joined an affiliated group by

Q89: ParentCo acquired all of the stock of

Q130: The losses of a consolidated group member