Multiple Choice

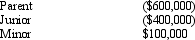

The Philstrom consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss (NOL) that is apportioned to Parent.

A) $0. The SRLY rules apply.

B) $900,000. All NOLs of a consolidated group are apportioned to the parent.

C) $600,000.

D) $540,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: When a member departs a consolidated group,it

Q64: When a subsidiary sells to the parent

Q90: Where are the controlling Federal income tax

Q94: The Parent consolidated group reports the following

Q96: The Philstrom consolidated group reported the following

Q98: List three "intercompany transactions" of a Federal

Q100: How must the IRS collect the liability

Q102: ParentCo's controlled group includes the following members.

Q113: All members of an affiliated group have

Q125: ParentCo owned 100% of SubCo for the